Transforming and reimagining how we investigate financial crime at Capital One

My role

Principal Product Designer (UX research, UI/UX design, prototyping, strategy, team building)

Timeline

November 2019–May 2022, including MVP and PMF launches (2.5 years)

I worked with…

1 Product Designer, 3 Design Engineers, multiple Tech and Product partners, and additional stakeholders

Overview

Risk management is critical to the health and continued existence of a bank. At Capital One, we have an army of experts who are trained to assess risk and make decisions based on what they find, but often their processes and workflows can be inherently complicated, time-consuming, and very manual.

We found ourselves wondering: How might we use technology to help make these processes and workflows for performing financial crime investigations more predictable, repeatable, and intelligent?

The Challenge

In 2018, the existing AML investigative platform did not facilitate a best-in-class program. There were over 140 manual processes and reports, only 4 investigations per investigator per day being completed, and investigators were routinely accessing 10-15 different systems to do a single investigation. The platform was lacking many desired capabilities and its tools felt disparate and inflexible.

Additionally, there was a desire from our FIU stakeholders to streamline the investigative process to ensure compliance - we needed to strike a balance between designing a usable tool for investigators and supervisors, while also managing the risk that comes with simplifying such a complex space.

Our Goals

The Clarity team was, and continues to be, oriented on delivering an investigative platform that consolidates all of the data and tools necessary to investigate and resolve an event in a timely, accurate, efficient, and fully-documented manner.

Increased quality & consistency of outputs

Improvement in investigator throughput

Increased AML customer satisfaction

Discovery

Empathy interviews and side by side observation sessions were performed in order to understand investigator core needs, behaviors, and overall journey.

Prototyping and testing

After creating wireframes, rapid prototyping, and user testing an initial design with investigators from various lines of businesses, we learned a few lessons very quickly:

(1) we needed a more flexible navigation to account for the extreme complexities of investigations and (2) surfacing connections and relationships enable investigators to understand the “bigger picture” quickly without having to dig for data.

Iteration

With learnings from user testing, we proposed updates to the overall Clarity experience, specifically its navigation. With these updates, we worked to influence the prioritization of surfacing relationships between people, accounts, and businesses to investigators.

Solution

Clarity is a centralized tool that enables the entirety of even the most complex investigations: from intake of alerts, assignment of resources and tracking, and reviewing and analyzing data, to making decisions and sharing. Clarity is still being developed and has already simplified the investigator experience at Capital One, providing numerous benefits to our anti-money laundering (AML) program including improved investigative quality, enhanced associate experience, improved technology profile and compatibility with machine-learning innovation.

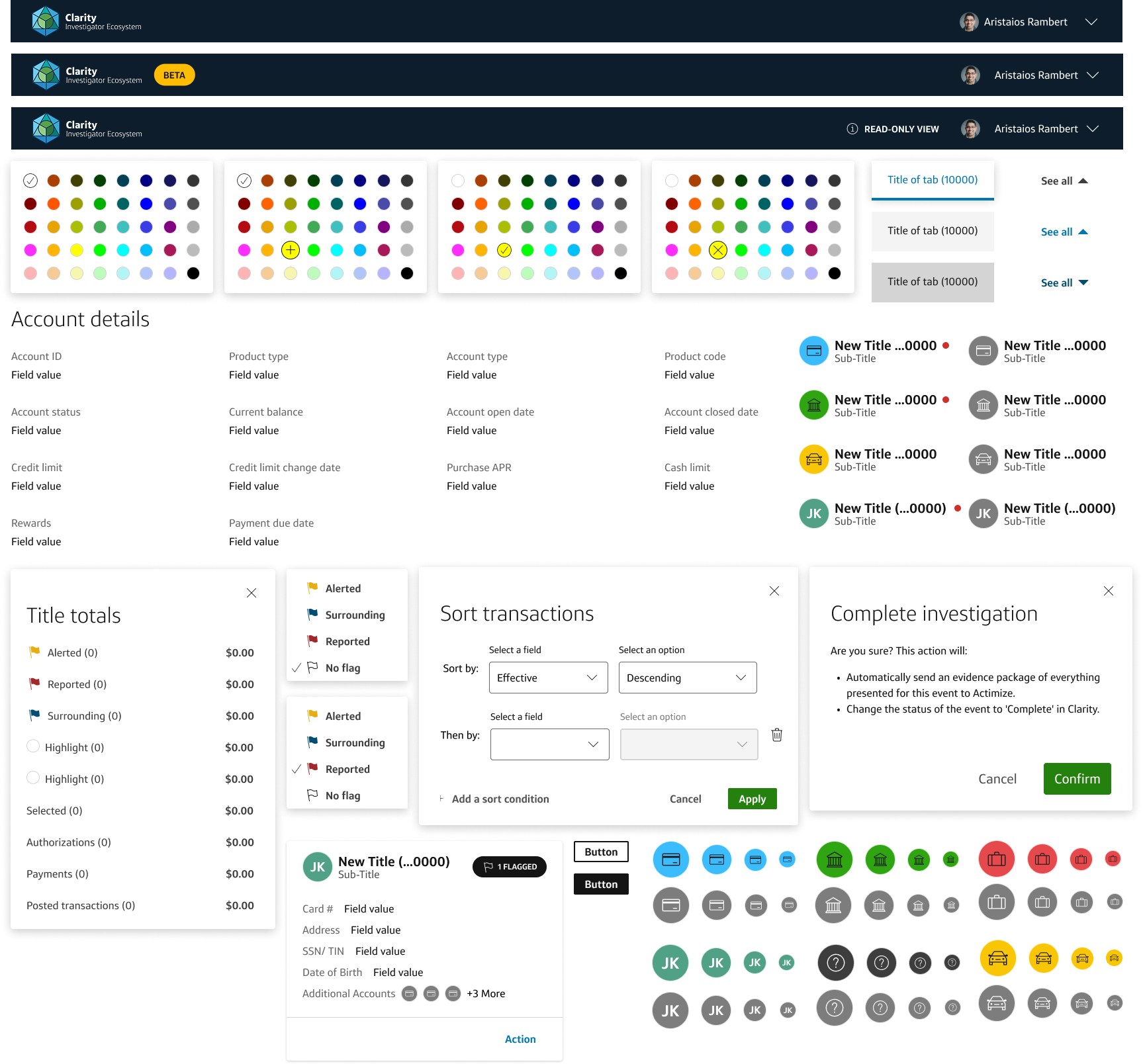

Design library

Clarity’s design library was made up of both reusable and interactive UI tokens and UI components

Theresa, AML investigator

“It’s almost like if you had a secretary that would gather all of your information, then put a folder on your desk and say ‘well, here you go. Here’s everything you need.’ That’s kind of like what Clarity is… and before, I was the secretary and the investigator.”

Impact

33% ↑

in throughput for COAF ML

15% ↑

Net Promoter Score (NPS) compared to existing tools

33% ↓

in new hire training time

Interested in more?

Other work from Capital One